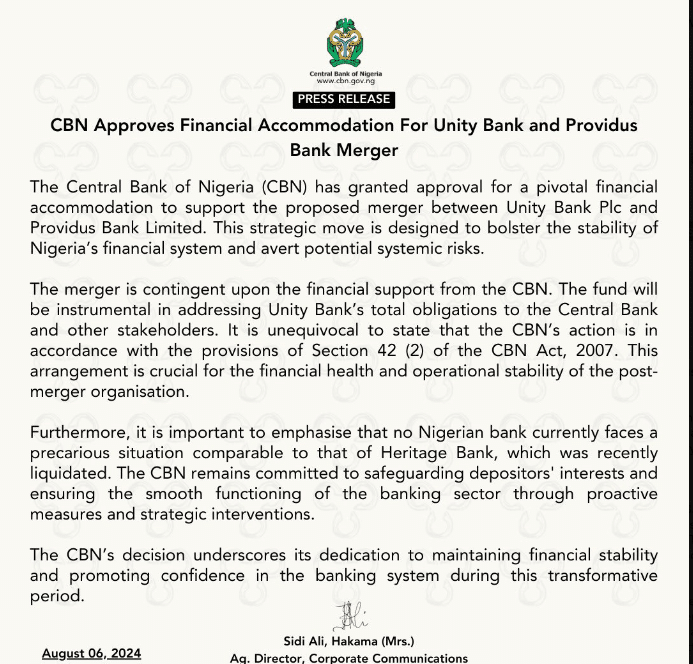

The Central Bank of Nigeria (CBN) has granted the approval for a pivotal financial accommodation to support the proposed merger between Unity Bank Plc and Providus Bank Limited. The apex bank made this known in a statement on Tuesday through its acting Director of Corporate Communications, Hakama Sidi-Ali.

Sidi-Ali confirmed that the move is designed to bolster the stability of the nation’s financial system and avert potential systemic risks. The CBN reiterated their commitment to safeguarding depositors’ interests and ensuring the smooth functioning of the banking sector through proactive measures and strategic interventions.

The statement partly read “The merger is contingent upon the financial support from the CBN. The fund will be instrumental in addressing Unity Bank’s total obligations to the Central Bank and other stakeholders.

“It is unequivocal to state that the CBN’s action is under the provisions of Section 42 (2) of the CBN Act, 2007. This arrangement is crucial for the financial health and operational stability of the post-merger organisation.

“It is important to emphasise that no Nigerian bank currently faces a precarious situation comparable to that of Heritage Bank, which was recently liquidated.”

Remember that the CBN had earlier in March pegged the new minimum capital base for commercial banks with national authorisation at N200 billion, while the new requirement for those with regional authorisation at N50 billion. The CBN had announced the capitation as a need to service a $1 trillion economy ambition of the President Bola Tinubu administration. They also advised mergers and acquisitions to help banks increase their capital base.